Unlocking the Sparkle: Unveiling the Potential of Investing in Diamonds

Historical Performance:

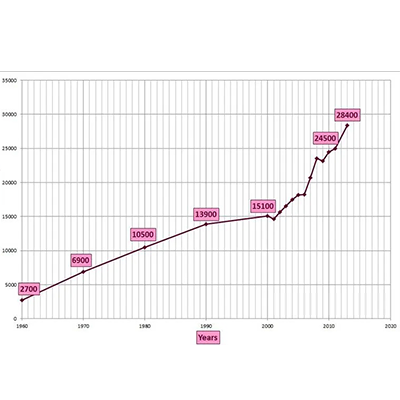

Long-Term Value Appreciation: Analyze historical data on diamond price trends, highlighting their consistent value appreciation over the long term.

Tangible and Portable: Discuss the advantages of diamonds as a portable and easily divisible asset, which can be stored and transported with relative ease compared to other investments.

Diversification Benefits:

Non-Correlated Asset: Explore how diamonds have demonstrated a lack of correlation with traditional financial markets, offering potential diversification benefits to investors.

Portfolio Risk Management: Examine studies that demonstrate the potential risk reduction achieved by adding diamonds to investment portfolios, providing stability during times of market volatility.

Rarity and Scarcity:

Supply and Demand Dynamics: Investigate the factors influencing diamond supply and demand, including limited mine production and growing consumer demand from emerging markets.

The Rarity Factor: Explore studies that highlight the finite nature of diamonds and their potential for increased value due to their rarity.

Hedge Against Inflation and Currency Risk:

Inflation Hedge: Discuss research that suggests diamonds can act as a hedge against inflation, preserving purchasing power over time.

Currency Risk Mitigation: Examine studies that propose diamonds as a potential hedge against currency devaluation and geopolitical risks.

Diamond Investment Vehicles:

Physical Diamonds: Explore the option of investing directly in physical diamonds, considering factors such as quality, certification, and storage.

Diamond Funds and Indices: Discuss the emergence of diamond investment funds and indices, providing opportunities for diversification and access to a broader range of diamonds.

Factors to Consider:

Quality and Certification: Highlight the importance of considering the 4Cs (cut, color, clarity, and carat weight) and reputable certification when evaluating diamond investments.

Market Dynamics: Discuss the significance of staying informed about global diamond market trends, including the influence of consumer preferences, production, and pricing dynamics.

Risks and Challenges:

Illiquidity: Address the potential challenge of liquidity in the diamond market and the need for a long-term investment horizon.

Counterfeit and Certification Issues: Explore the risks associated with counterfeit diamonds and the importance of reputable certification to ensure investment authenticity.

Investing in diamonds offers a unique opportunity to diversify portfolios, preserve wealth, and potentially achieve attractive returns over the long term. While diamonds possess inherent qualities that make them an appealing investment asset, it is crucial to consider factors such as quality, market dynamics, and associated risks. By staying informed and leveraging the insights provided by studies and research, investors can make informed decisions and unlock the sparkle of diamond investments, adding a touch of glamour to their investment portfolios.